SUPPORT

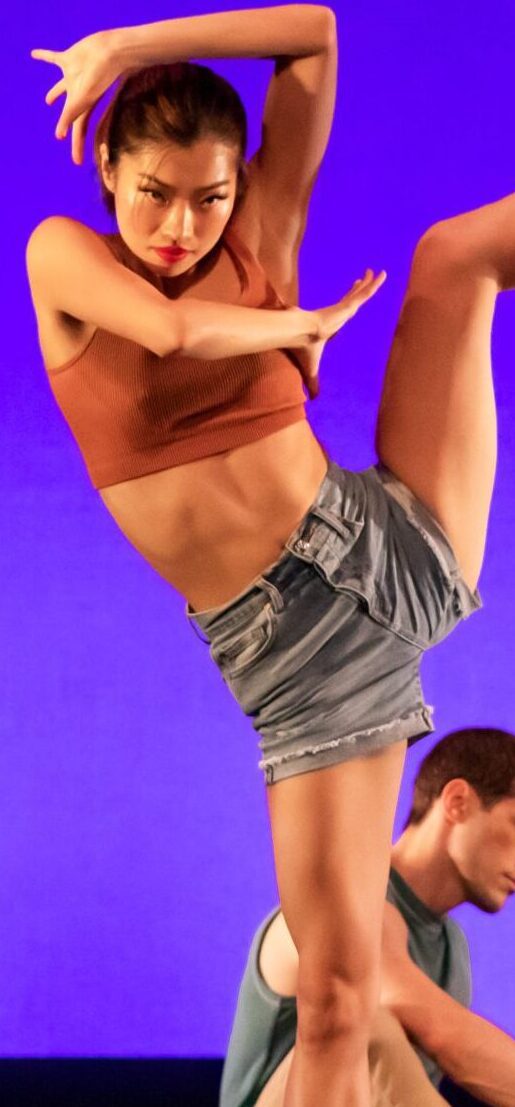

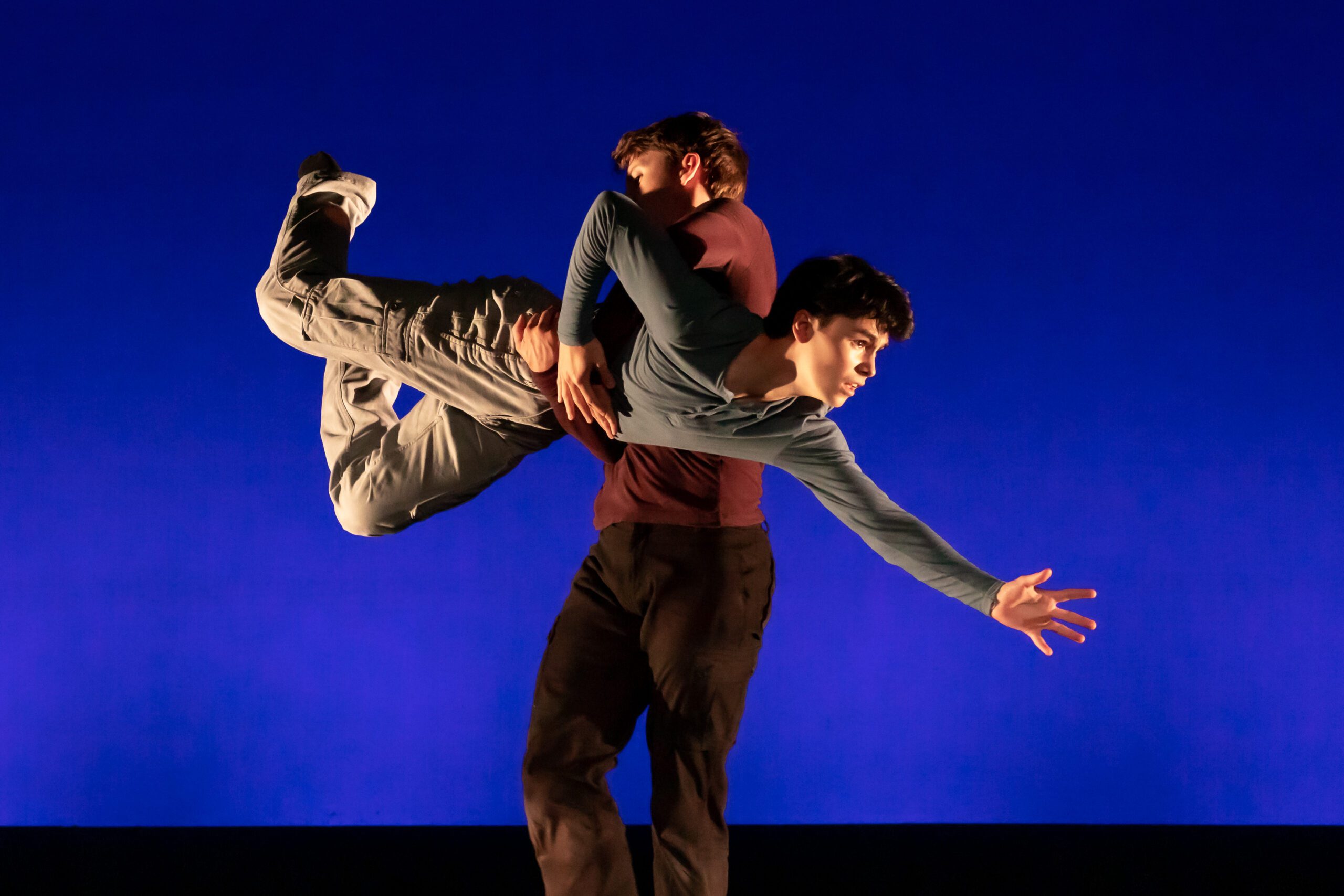

For over ten years, Chamber Dance Project has been creating extraordinary experiences in contemporary ballet and live music in Washington, D.C. The results are true collaborations among dancers, musicians, and other artists that result in resounding audience responses and standing ovations. We wouldn’t be where we are without the support of our fantastic members, Board, corporate sponsors and donors!

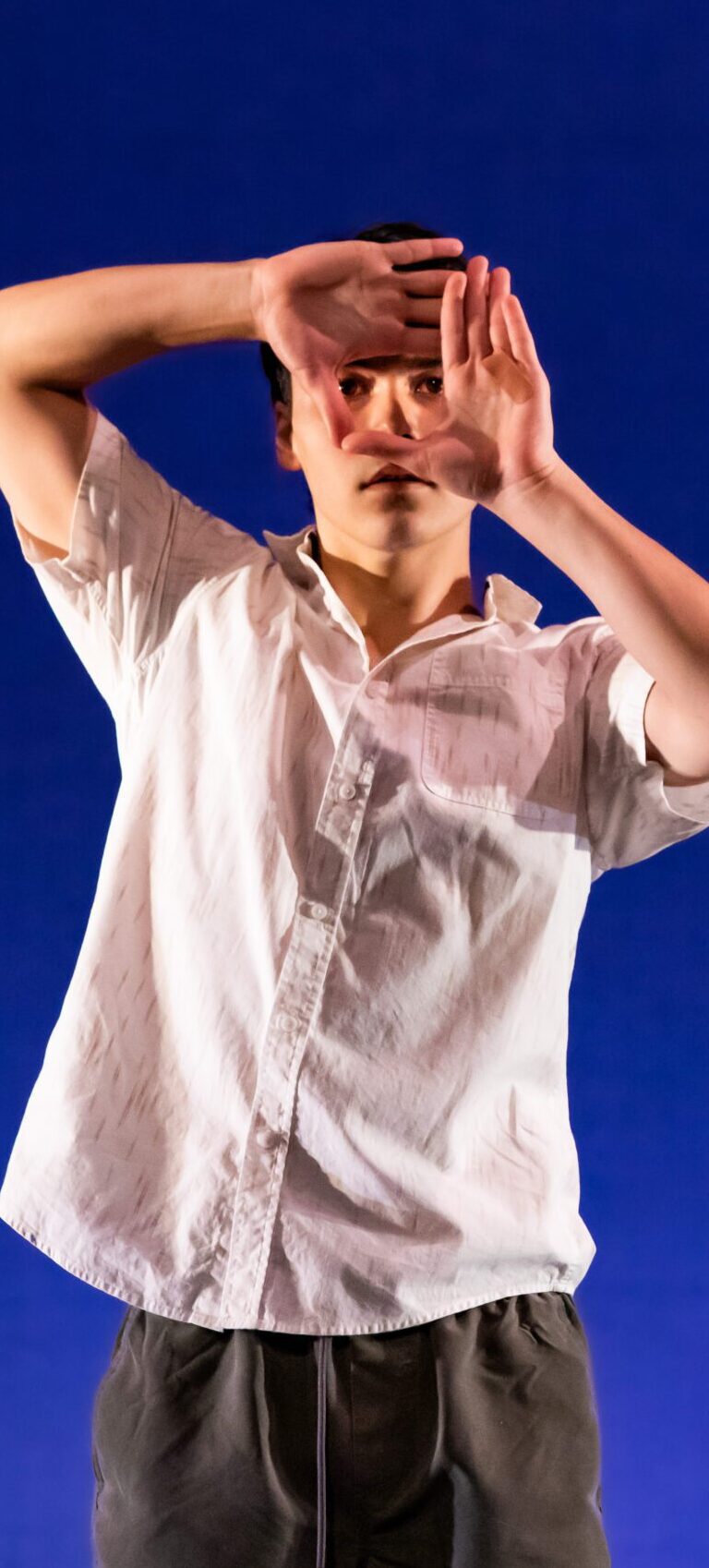

Get Closer to the Art

Become a member today

Join a community of passionate dance and music enthusiasts dedicated to experiencing the bold and innovative. As a member, you’ll gain unparalleled access to the creative process, witnessing firsthand how new works come to life. You’ll enjoy exclusive opportunities to engage directly with our dancers, musicians, and guest choreographers, forging meaningful connections both onstage and behind the scenes. Membership brings you closer to the art than ever before—don’t just support the work, become part of its creation.

Memberships are active for one year from the gift date and can be renewed yearly. Find a membership that works for you.

Member Benefits & Privileges

Scroll right to see more of the table →

| Program Listing | Open Rehearsals* | Fall Members' Reception* | Early Ticket Access & Discounts | Artist Evenings* | Dinner with the Artists | New Works Fund Tea | Open Night Tickets and Recognition | |

|---|---|---|---|---|---|---|---|---|

| Young Professionals (35 and younger) $50 |

● | ● | ||||||

| Members $125 |

● | ● | ● | ● | ||||

| Premium Members $275 |

● | ● | ● | ● | ● | |||

| Travel & Housing Fund $500 |

● | ● | ● | ● | ● | ● | ||

| Artist Sponsors $750 |

● | ● | ● | ● | ● | ● | ● | |

| New Works Fund $1,500 |

● | ● | ● | ● | ● | ● | ● | |

| Season Sponsors $10,000+ |

● | ● | ● | ● | ● | ● | ● | ● |